The Rise and Fall of the Meme Phenomenon: Why AMC Entertainment Stock Won’t Be Saved by the Next Generation of Internet Memes

A 68% Chance of Recovery: A Glimmer of Hope

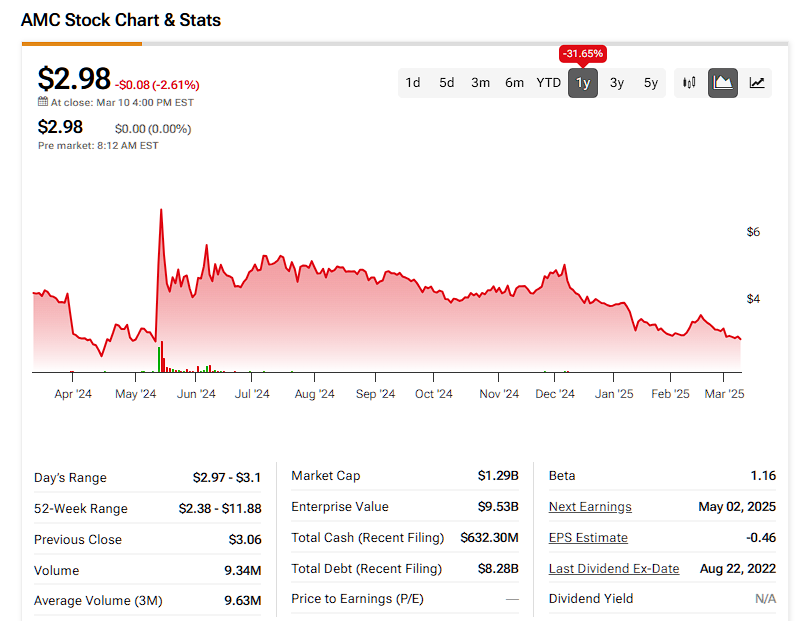

While AMC Entertainment (AMC) stock has been on a downward spiral, with a 99% implosion from its 2021 heights, some investors still hold onto hope that the stock will eventually turn things around. According to streak analysis, there is a 68% chance that AMC will end the week higher, providing a glimmer of hope for investors.

The Risks of Long-Term Investment

Negative Bias: A High Risk of Loss

Despite the occasional pop, AMC stock suffers from a negative bias, with a 45.34% chance of witnessing a profitable long position on any given week. Over eight weeks, the odds slip to 37.14%, making it a high-risk investment.

Poor Historical Pricing Data: A Long Odds Game

Historical pricing data reveals that AMC stock is a long shot, with the odds of winning decreasing as the investment period increases. This makes it a poor investment decision for those looking for a safe and stable return.

A Poor Investment Decision: Why AMC’s Not Worth the Risk

With a high debt load, declining box office sales, and a negative outlook, AMC stock is not a solid investment opportunity. The risks associated with investing in AMC far outweigh any potential benefits, making it a poor investment decision for most investors.

Practical Implications: Investing in AMC Stock

A Cautionary Tale: Why Investors Should Be Wary

Investors should be wary of investing in AMC stock due to its lack of volatility, making it unappealing to short-term traders. Additionally, the negative outlook and high risk of loss make it a poor investment decision for most investors.

A Lack of Volatility: A Turnoff for Some Traders

For short-term traders, a lack of volatility is a major turnoff, making AMC stock unappealing to those looking to capitalize on momentum.

A Negative Outlook: Why AMC’s Not a Solid Investment

The broader economic picture is not conducive to an upswing in AMC stock, with the labor market struggling and the benchmark S&P 500 facing one of its worst slumps in history.

A Better Alternative: Where to Invest Instead

Instead of investing in AMC stock, investors should consider alternative investment opportunities that offer a safer and more stable return.

The Art of Dynamic Probabilities: Analyzing AMC’s Risks

Fear and Greed: How AMC Responds to Market Sentiment

By analyzing how AMC stock responds to various magnitudes of fear and greed, investors can gain a better understanding of the risks associated with investing in AMC.

Long Odds: The Likelihood of Loss with AMC

The data is clear: the more you gamble on AMC (on the long side), the likelier you will lose money. This makes it a poor investment decision for most investors.

A Gamble Not Worth Taking: Why AMC’s Not a Solid Investment

With the long odds stacked against it, AMC stock is not a solid investment opportunity. Investors should be cautious and consider alternative investment opportunities that offer a safer and more stable return.

The Future of AMC: A Bleak Outlook

The future of AMC Entertainment Holdings, Inc. looks bleak, with a high debt load, declining box office sales, and a negative outlook. This makes it a poor investment decision for most investors.

Additional Insights: AMC Entertainment Holdings, Inc.

Company Background: A History of Theatrical Exhibition

AMC Entertainment Holdings, Inc. was founded in 1920 and is headquartered in Leawood, Kansas. The company engages in the theatrical exhibition business in the United States and Europe, owning, operating, or having interests in theatres.

A Brief Overview: The Company’s Theatrical Exhibition Business

The company’s theatrical exhibition business is a significant player in the industry, with a wide range of ownership and interests in theatres.

Conclusion

Conclusion: The Meme Effect: A Fleeting Savior for AMC Entertainment

As we conclude our analysis of why meme mania cannot save AMC Entertainment (AMC) stock, it’s clear that the highly speculative and volatile nature of meme-driven market movements poses a significant challenge for investors. The article highlighted the key factors that contribute to the limited impact of meme mania on AMC’s stock performance, including the company’s fundamental financial health, the lack of substantial catalysts, and the risk of market fatigue. Furthermore, we examined the implications of meme-driven market movements on the broader market landscape, emphasizing the need for investors to separate hype from reality and focus on long-term fundamentals.

The significance of this topic cannot be overstated, as the intersection of social media, investing, and market psychology continues to shape the discourse around meme stocks. The AMC case serves as a cautionary tale, illustrating the dangers of basing investment decisions on fleeting emotions rather than sound analysis. As the meme effect continues to ebb and flow, investors would do well to remember that true value lies in the underlying fundamentals, not in the whims of retail traders or social media influencers. As we move forward, it will be essential to monitor the evolving landscape of meme stocks and their impact on market dynamics.

In the end, the meme effect is a fleeting phenomenon that cannot be relied upon to save AMC’s stock or any other company’s fortunes. As investors, we must remain vigilant and focused on the long-term prospects of the companies we invest in, rather than getting caught up in the hype of short-term market movements. The future of AMC’s stock will ultimately depend on its ability to execute on its business strategy, manage its debt, and create sustainable value for its shareholders. Will the company be able to overcome its challenges and achieve its goals, or will the meme effect continue to hold it back? Only time will tell, but one thing is certain: the line between meme-driven hype and reality is thinner than ever, and investors must proceed with caution.