## Decoding the Business Bank Statement: Your Financial Story in Numbers

Running a tech startup is a rollercoaster ride. You’re juggling innovation, customer acquisition, and, let’s face it, a whole lot of paperwork. Among the mountains of invoices and receipts, the business bank statement might seem like just another mundane document. But hold on! It’s actually your financial story, told in a language of numbers and transactions.

Banking Records

Accessing your bank statements and online banking data is the first step in maintaining accurate financial records. Online banking provides you with 24/7 access to your account, allowing you to view transaction details, download account statements, and manage your finances efficiently. For instance, most banks provide the option to download transactions in CSV or QIF format, which can then be imported into accounting software.

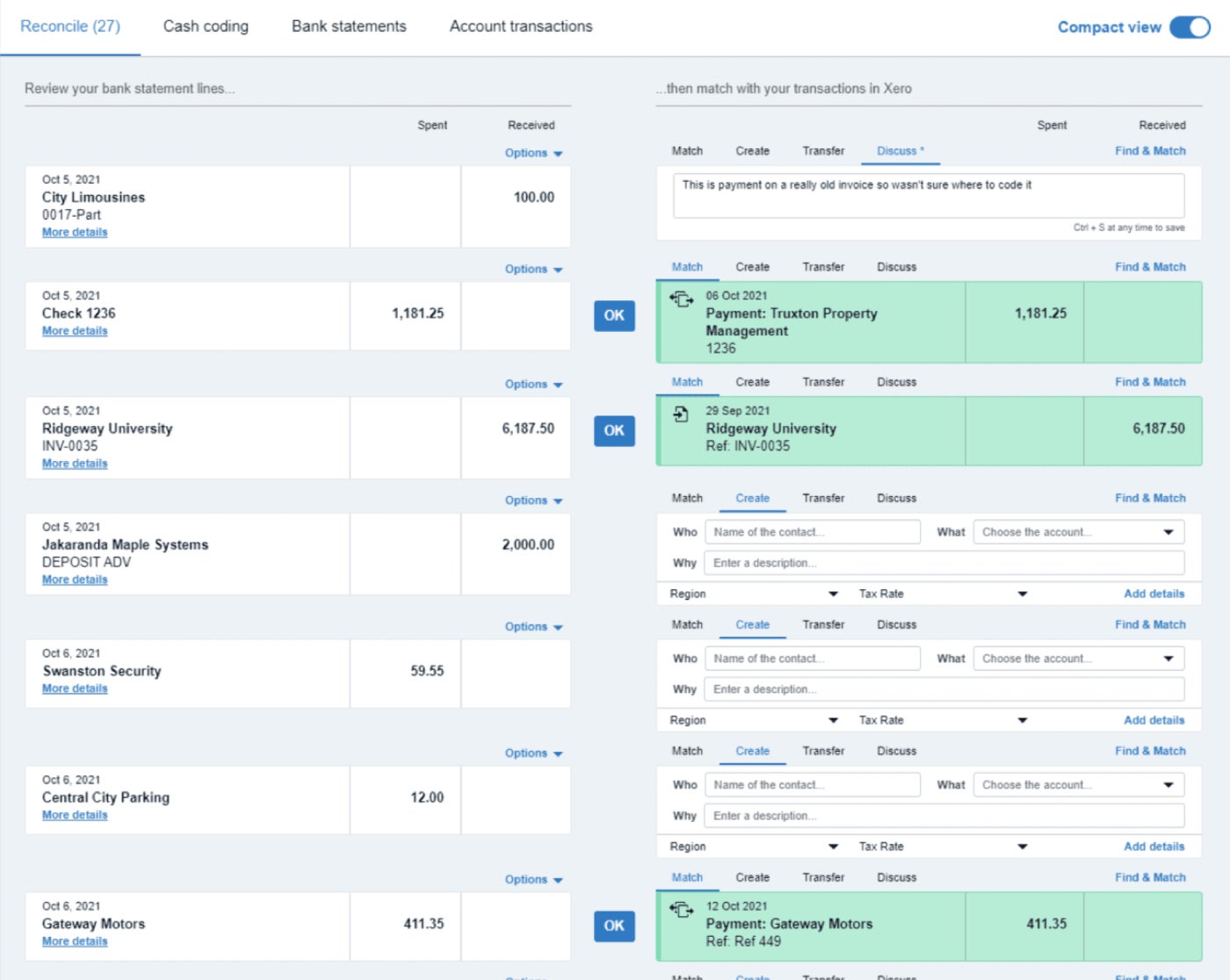

Importing transactions through accounting apps like QuickBooks, Xero, or FreshBooks can automate the reconciliation process. These apps can sync with your bank account, automatically downloading and categorizing transactions for you, which helps in reducing manual entry errors and saving time.

Company Books

Accessing accounting records and logs is crucial for day-to-day operations and long-term financial planning. Accounting software provides a detailed overview of all financial activities, including cash flow, inventory, and expense tracking, which can be cross-referenced with bank statements.

Utilizing accounting software such as QuickBooks or Sage offers advanced features like automatic importing of bank transactions, which can significantly streamline the reconciliation process. These tools also allow for generating financial reports and performing audits, ensuring your financial records are accurate and up-to-date.

Comparing Bank and Accounting Records

Identifying Discrepancies

Common discrepancies might include uncleared checks, pending transactions, unauthorized charges, or arithmetic errors. Tools like bank reconciliation software can help match transactions, highlight discrepancies, and provide a clear report of outstanding items.

Methods for accurate comparison include using checksums, which are unique identifiers for each transaction, or manually cross-checking transaction dates, amounts, and descriptions to ensure accuracy.

Resolving Discrepancies

Steps to correct errors and fraud involve identifying the source of the discrepancy, making necessary adjustments to the general ledger, and documenting any corrections or adjustments made. If fraud is suspected, it is crucial to document findings and report to the appropriate financial authorities or law enforcement.

Closing a Business Bank Account

Preparing for Account Closure

Opening a New Account (if Necessary)

Evaluating new business banks involves assessing service fees, interest rates, and customer service quality. For example, Bluevine Business Checking offers competitive rates and no monthly fees, making it an attractive option for businesses needing a new account. Ensure that the new account can handle all your business’s financial needs without interruption.

Transitioning Automatic Transactions

Updating payment methods and direct deposits involves notifying all relevant parties, such as payroll processors and vendors, of the new account information. Moving recurring transactions includes updating direct deposit information, subscriptions, and regular payments to avoid service interruptions.

Settling the Old Account

Reconciling and Settling

Ensuring no pending transactions means meticulously checking for any outstanding transfers, payments, or fees that need to be cleared before the account is closed. Paying outstanding fees and withdrawing remaining funds is essential to avoid incurring any additional charges from the bank.

Addressing Tax Implications

Consulting with financial advisors is crucial to understand any tax implications of account closure, especially if significant funds are being transferred or withdrawn. Reviewing special rates and benefits ensures you are aware of any perks or discounts that might be lost upon closure, which could impact your financial planning.

Gathering Documentation

Required Documents

The necessary documentation typically includes your business name, address, tax ID number, proof of authorization, and account details. This documentation ensures the process of closing the account is handled smoothly and legally.

Legal Requirements

Business entity regulations, such as LLC or corporation rules, might need formal resolutions or board approvals. Tax obligations must also be settled, and relevant tax authorities, like the IRS, need to be notified of the account closure.

Practical Tips for Geeksultd Users

Streamlining the Reconciliation Process

Utilizing Accounting Software

Best practices for using accounting apps include setting up automated bank feeds, regularly updating your software, and using automated reconciliation features. This can significantly reduce the time and effort required to maintain accurate records.

Regular Audits and Reviews

Scheduling routine reconciliations and audits is vital to maintaining financial integrity. For example, setting a monthly schedule for reconciliations helps identify and address any discrepancies early. Conducting periodic audits with external auditors can also increase the reliability and accuracy of your financial records.

Ensuring Financial Integrity

Fraud Detection Tips

Common signs of fraud include unauthorized transactions, discrepancies between bank statements and internal records, and sudden changes in account balances. To prevent fraud, implement preventive measures such as two-factor authentication and regular monitoring of account activity.

Error Prevention

Best practices for accurate record-keeping include double-checking all entries, maintaining a clear and organized filing system, and training staff on the importance of accurate record-keeping and reconciliation practices.

Conclusion

Conclusion: Unlocking the Power of Business Bank Statements

In our exploration of business bank statements, we delved into the essential definition, examples, and the significance of this financial document. The article shed light on the importance of maintaining accurate and up-to-date records, enabling businesses to make informed financial decisions. Key takeaways include understanding the components of a business bank statement, recognizing the differences between personal and business accounts, and leveraging statement analysis to optimize cash flow management and identify potential risks. By grasping these concepts, businesses can better navigate the complexities of financial management, mitigate potential pitfalls, and drive growth.

The implications of business bank statements extend beyond mere financial record-keeping. They offer a critical window into a company’s financial health, enabling stakeholders to assess performance, identify areas for improvement, and make data-driven decisions. As businesses navigate the ever-evolving landscape of financial regulations and technological advancements, the importance of accurate and timely financial reporting will only continue to grow. By embracing best practices in financial management and staying attuned to the latest trends and tools, businesses can unlock new opportunities for growth, innovation, and success.